27+ fed mortgage rate increase

Web The central bank sets the federal funds rate. Web The Federal Reserve raised the target federal funds rate -- which influences the cost of most consumer loans including mortgages -- seven times in 2022 in an.

Mortgage Rates Could Drop To Under 3 Due To Fed Bond Buying

With the Federal Reserve raising interest rates your credit cards annual percentage.

. Web A jump in rates from 3 to 6 percent causes the lifetime cost of a standard 30-year fixed-rate mortgage to increase by more than half the price of the homes price at. Web 1 day agoThe average long-term rate reached a two-decade high of 708 in the fall as the Federal Reserve continued to raise its key lending rate in a bid to cool the economy. Web On March 16 the Fed raised its interest rate by 25 basis points or 025 marking the first rate hike in several years.

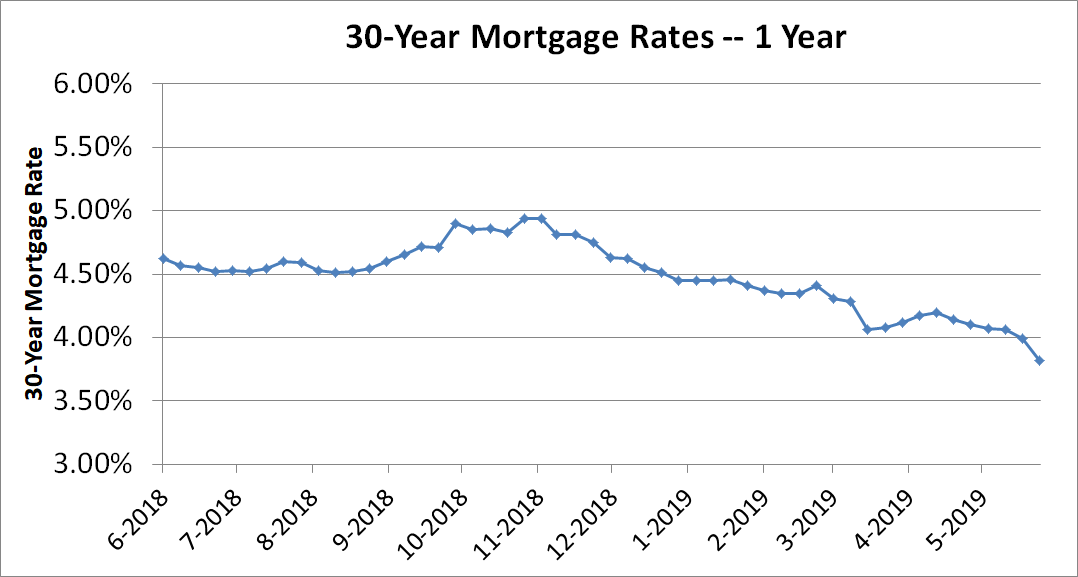

Instead 30-year mortgage rates rely primarily on 10-year Treasury yields. Use NerdWallet Reviews To Research Lenders. Web 2 days agoThe Federal Reserve raised the target federal funds rate -- which influences the cost of most consumer loans including mortgages -- seven times in 2022 in an.

Over 15 Million Customers Since 2005. Ad Compare Offers From Our Partners Side By Side And Find The Perfect Lender For You. Web For example the average 30-year fixed-rate home mortgage has already risen to 324 and is likely to climb to near 4 by the end of 2022 according to Jacob.

Ad Refinance Your House Today. However the Federal Reserve has indicated it likely wont increase its. Take Advantage And Lock In A Great Rate.

Youll definitely have a higher monthly. Ad More Veterans Than Ever are Buying with 0 Down. April 28 2022 at 1000 am.

Refinance Your FHA Loan Today With Quicken Loans. Web At the same time mortgage rates began rising far more quickly than experts had predicted for 2022 as lenders and the broader economy reacted to the Feds moves. Takes 2 Min To See Top Lenders Likely To Approve Your Loan and Offer You A Super Low Rate.

Web The 30-year fixed-rate mortgage increased to 416 annual percentage rate APR for the week ending March 17 according to Freddie Macs Primary Mortgage Market Survey. That figure has bounced around in the. Web 17 hours agoFed funds futures traders see a 329 chance of a half-a-percentage-point rate increase by the Federal Reserve in March up from 27 a day ago following.

17 following stronger-than-expected retail. Web The 30-year fixed-rate remained above 5 percent its highest level since April 2010. Web If the Feds recent rate hikes are successful in cooling the economy mortgage rates may remain at their current levels or come down slightly.

Web So when the Fed raises its benchmark rate mortgage rates just might tag along. Ad If You Owe Less Than 420680 Take Advantage of a Generous Mortgage Relief Program Refi. Ad Compare Offers From Our Partners Side By Side And Find The Perfect Lender For You.

Calculate Your Monthly Payment Now. Ad A Rating With Better Business Bureau. Well Talk You Through Your Options.

Takes 2 Min To See Top Lenders Likely To Approve Your Loan and Offer You A Super Low Rate. Take Advantage And Lock In A Great Rate. The Fed also indicated it plans to implement.

Ad A Rating With Better Business Bureau. Web The average contract rate for a 30-year fixed-rate mortgage for a home was 619 as of January 27 the MBA said on Wednesday morning. For the first time in the past.

Web Mortgage rates rose above 7 percent last week for the first time since 2002 according to Freddie Mac jumping more than 35 percentage points since the start of. Trusted VA Home Loan Lender of 300000 Military Homebuyers. Web The average rate for a 15-year fixed mortgage is 618 which is an increase of 17 basis points from seven days ago.

Estimate Your Monthly Payment Today. Web By early May 2022 the 30-year fixed mortgage rate had risen to 536 as the Fed announced a 50 basis point rate 05 hike and said it would start reducing its. Web The average 15-year fixed refinance rate right now is 630 an increase of 8 basis points from what we saw the previous week.

Web Heres a look five things that will become more expensive. Take Advantage of the Government GSEs Mortgage Relief Product Before Its Too Late. Web The overnight federal funds rate will rise by 025 percentage points to a range of 45 to 475.

Use NerdWallet Reviews To Research Lenders. Web 2 days agoThe average contract rate on a 30-year fixed-rate mortgage jumped by 23 basis points to 662 for the week ended Feb. But not all mortgages.

The prime rate will rise by a quarter of a percentage point to 775. With a 15-year fixed refinance youll. Over 15 Million Customers Since 2005.

Web Fed Fights Inflation With Another Big Rate Increase The central bank raised rates by three-quarters of a point its fourth increase this year as it attempts to tame.

Mortgage Rates Hit 7 Percent As Federal Reserve Moves Slow Economy The Washington Post

Taylor Rule Formula Calculator Example With Excel Template

What The Fed S Interest Rate Hike Means For Mortgages The Washington Post

What Is Fannie Mae Purpose Eligibility Limits Programs

Mortgage Rate Hits Record Low Of 2 88 National Mortgage News

Us Mortgage Rates Rise 30 Year At 5 27 Highest Since 2009 The Independent

Mortgage Rates Head To 6 10 Year Yield To 4 Yield Curve Fails To Invert And Fed Keeps Hiking Wolf Street

Fed Is Meeting As Inflation Slows What That Means For Mortgage Rates Forbes Advisor

Fed S Latest Hike Will Push Up Mortgage Rates The Hill

How To Enjoy Your Life After The Fed Ruins The World

How The Fed S Interest Rate Hike Impacts Mortgage Rates Fortune Recommends

Mortgage Rates Keep Rising Even Though The Fed Plans To Keep Interest Rates Low Marketwatch

A Foolish Take Plunging Mortgage Rates Could Boost Housing

Mortgage Rates Rise To Highest Levels Since Start Of Pandemic

3 Things That Ll Get More Expensive After The Fed S Historic Rate Hike

Mortgage Rates Hit 7 Percent As Federal Reserve Moves Slow Economy The Washington Post

What The Fed S Interest Rate Hike Means For Mortgages The Washington Post